Fast Cash

Client

OneMain Financial

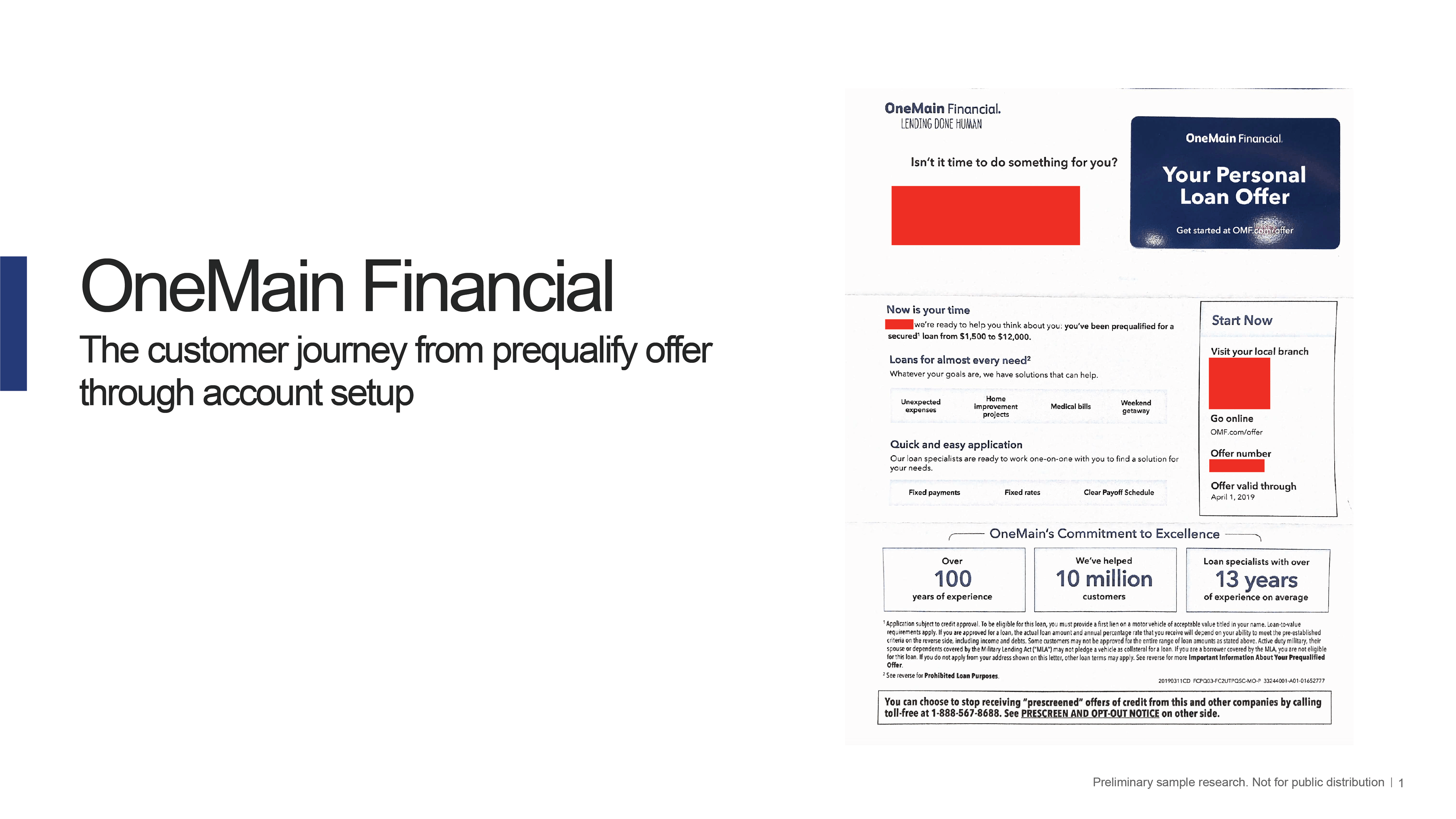

OneMain Financial

Background

OneMain Financial is a personal lending provider for non-prime customers (borrowers with credit scores between 600 and 660) who may not have access to traditional lenders like banks or credit card companies for critical financial needs like debt consolidation, home and auto repair, medical procedures, and other major expenses.

Their network of 1600+ brick-and-mortar branches across 44 states offers secured, and unsecured personal loans, as well as auto loans typically within the $1,500 and $20,000 range.

As the Covid-19 Pandemic was beginning to sweep the country in early 2020, and OneMain was in the process of transitioning their lending process fully online. Until that point, signing of the loan had to be finalized in person within a branch.

Enjoy the JourneyOps

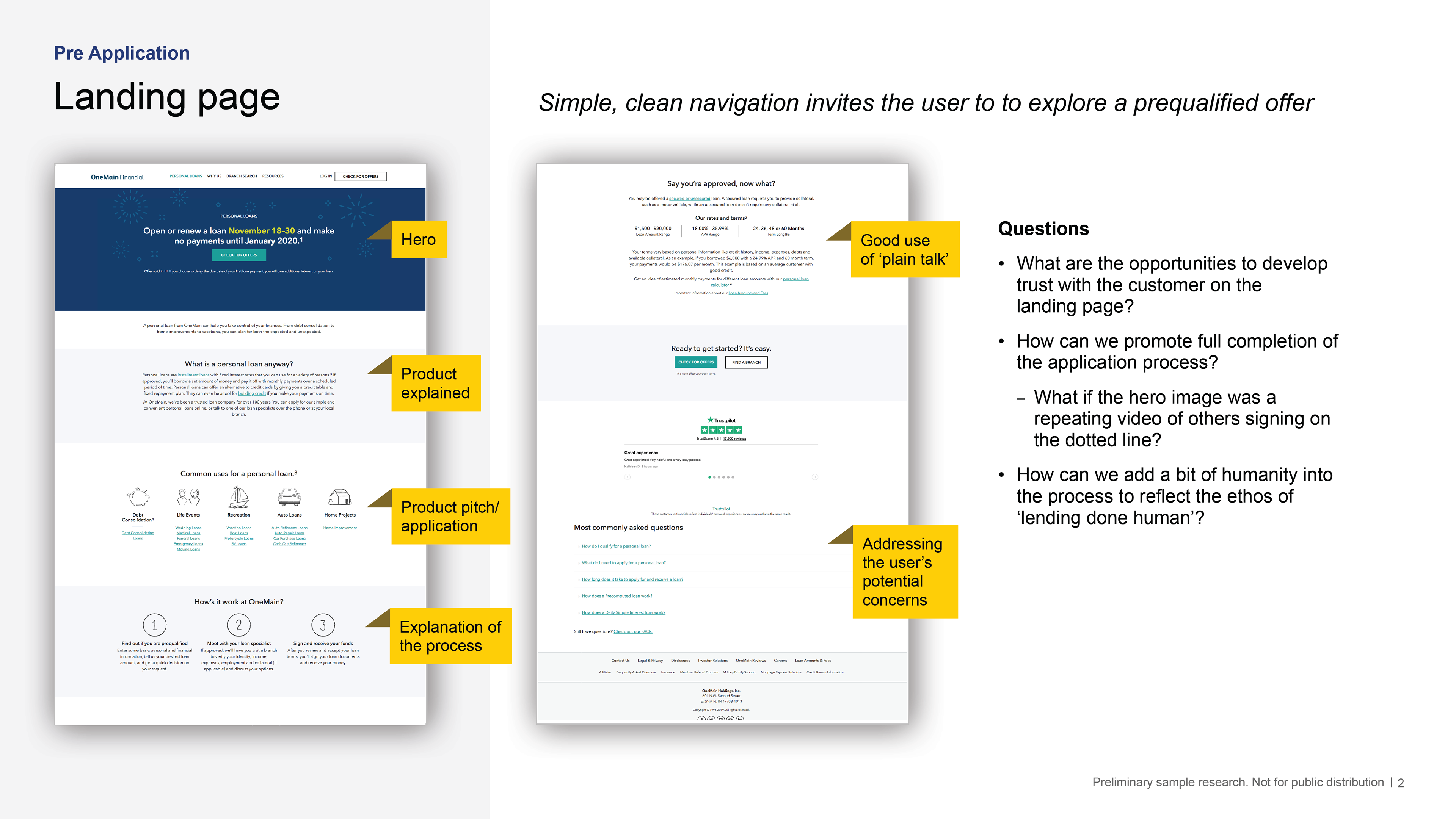

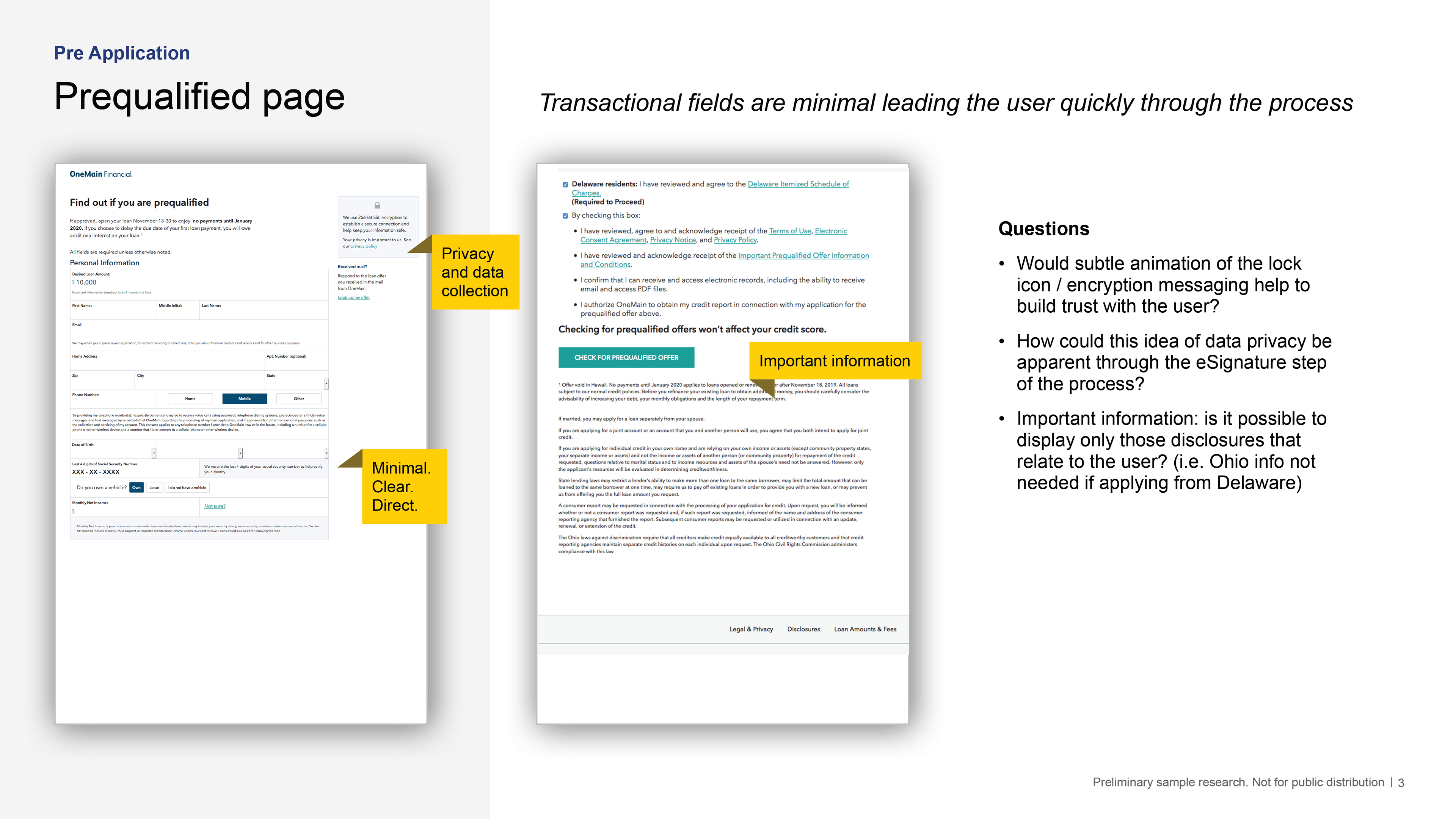

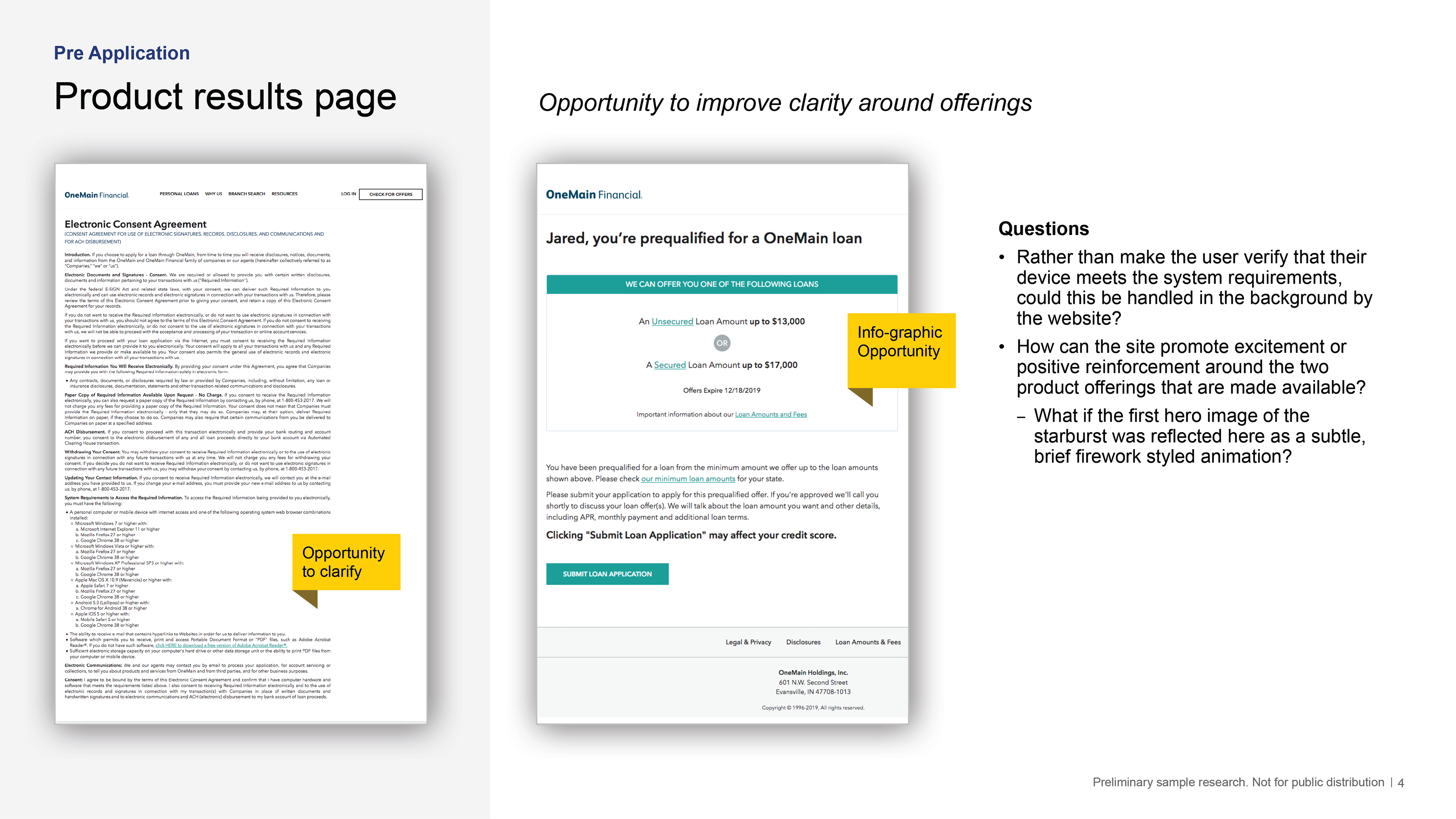

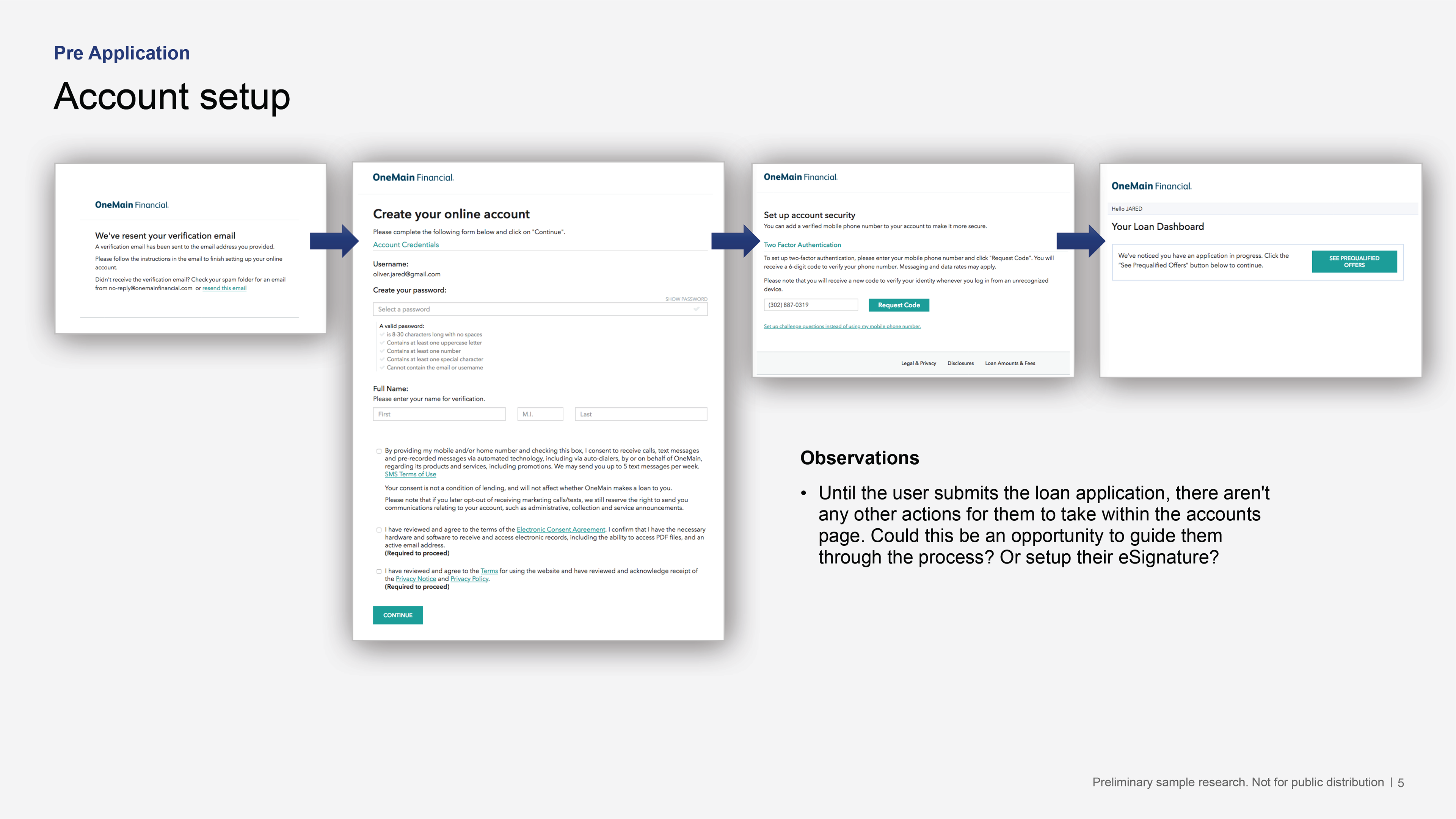

I began exploring the user journey through a site evaluation/audit to assess what the end to end experience looked like for the user, and then pair that with what the sales funnel looked like internal. I documented some of my initial impressions, blending heuristics, and usability testing through the lens of an omni-channel experience. I noted several initial observations and questions to help explore how we might improve the customer experience across channels. A few of these include:

» What are the opportunities to build trust on the landing page?

» Could a chatbot help to explain the legalese in plain English?

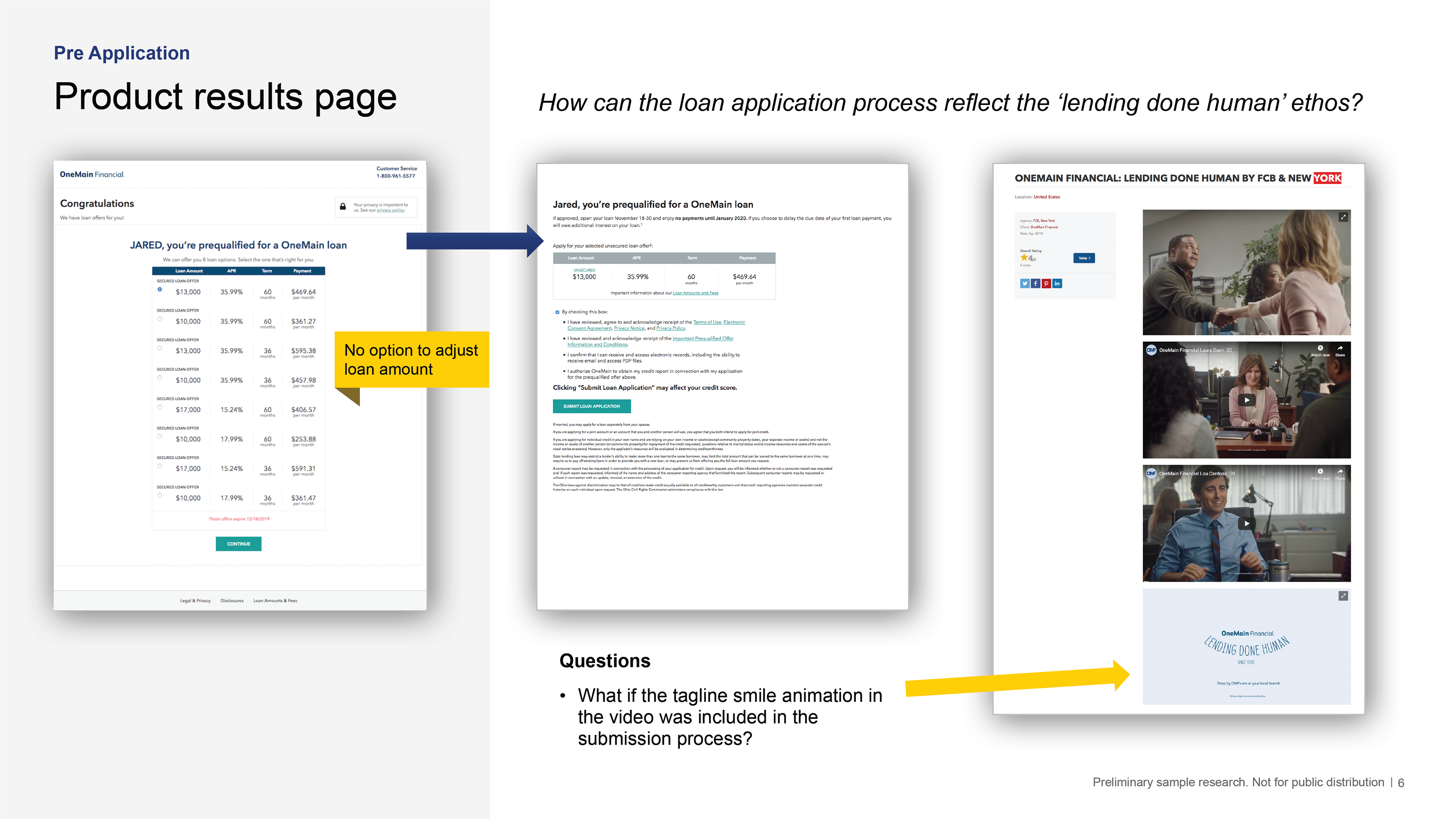

» What if the smile animation of the 'Lending Done Human'? tagline appeared in the loan option results page?

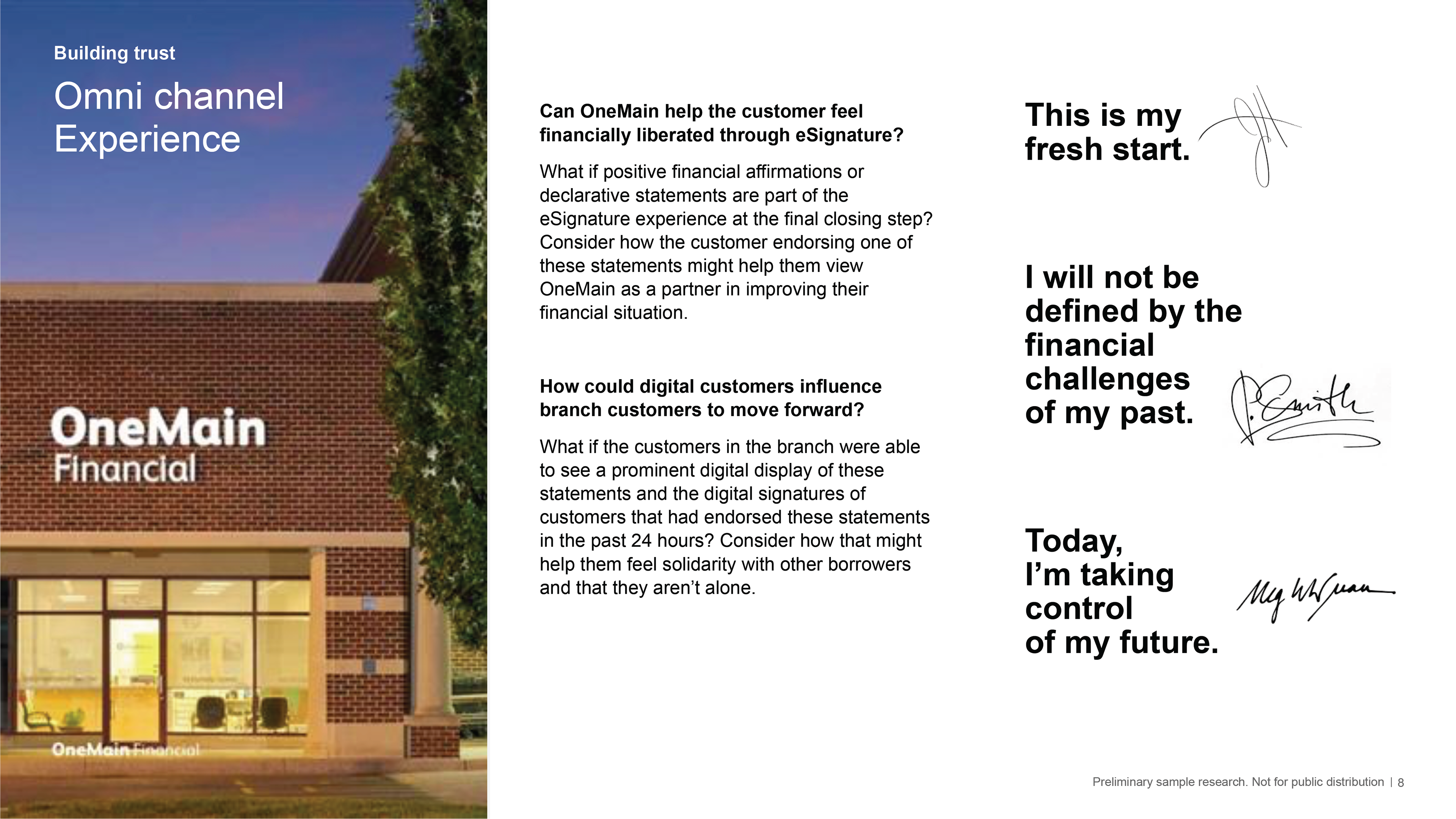

» How might OneMain help the customer to feel liberated through e-signature?

» Could a chatbot help to explain the legalese in plain English?

» What if the smile animation of the 'Lending Done Human'? tagline appeared in the loan option results page?

» How might OneMain help the customer to feel liberated through e-signature?

Process Mapping

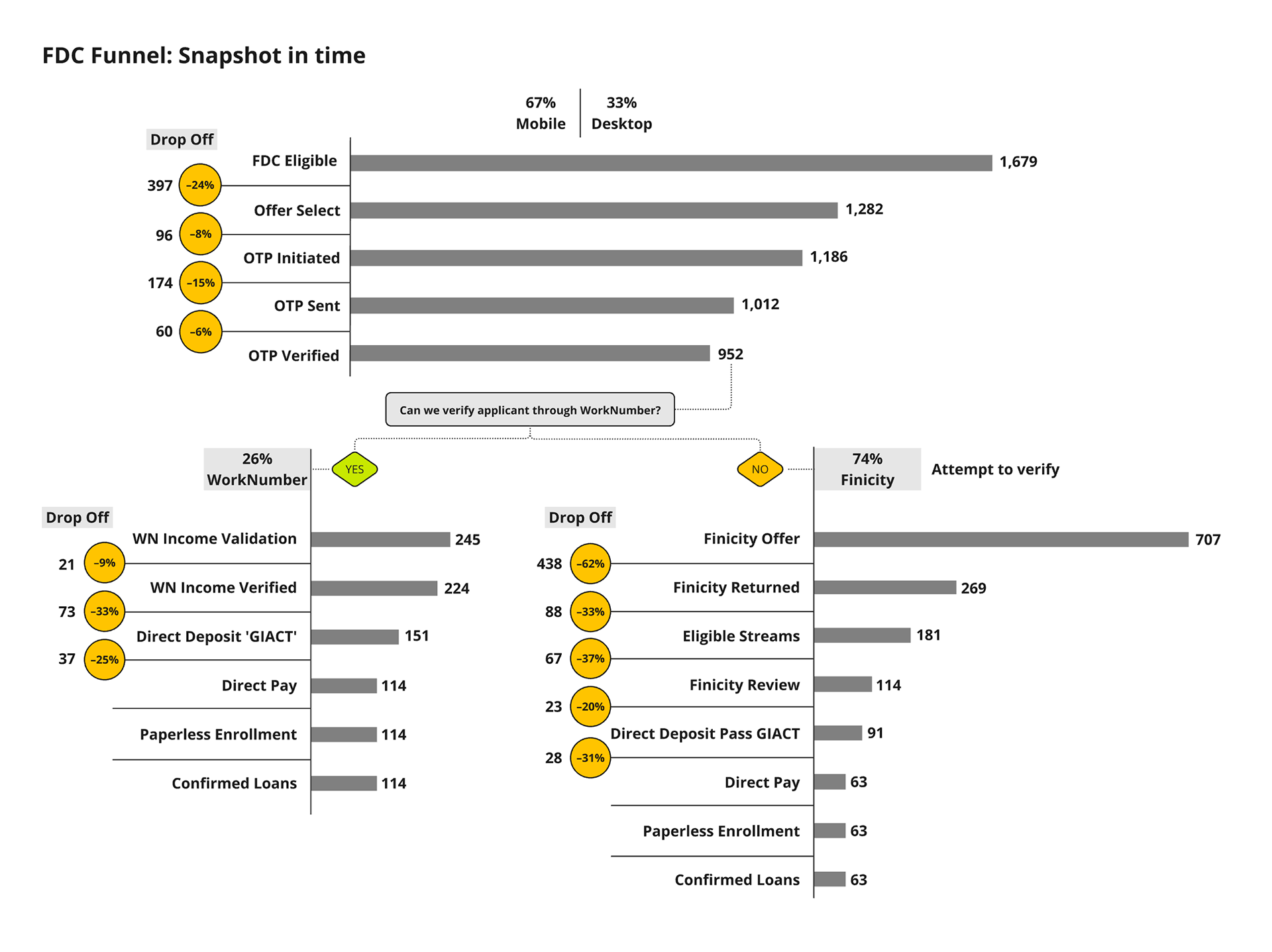

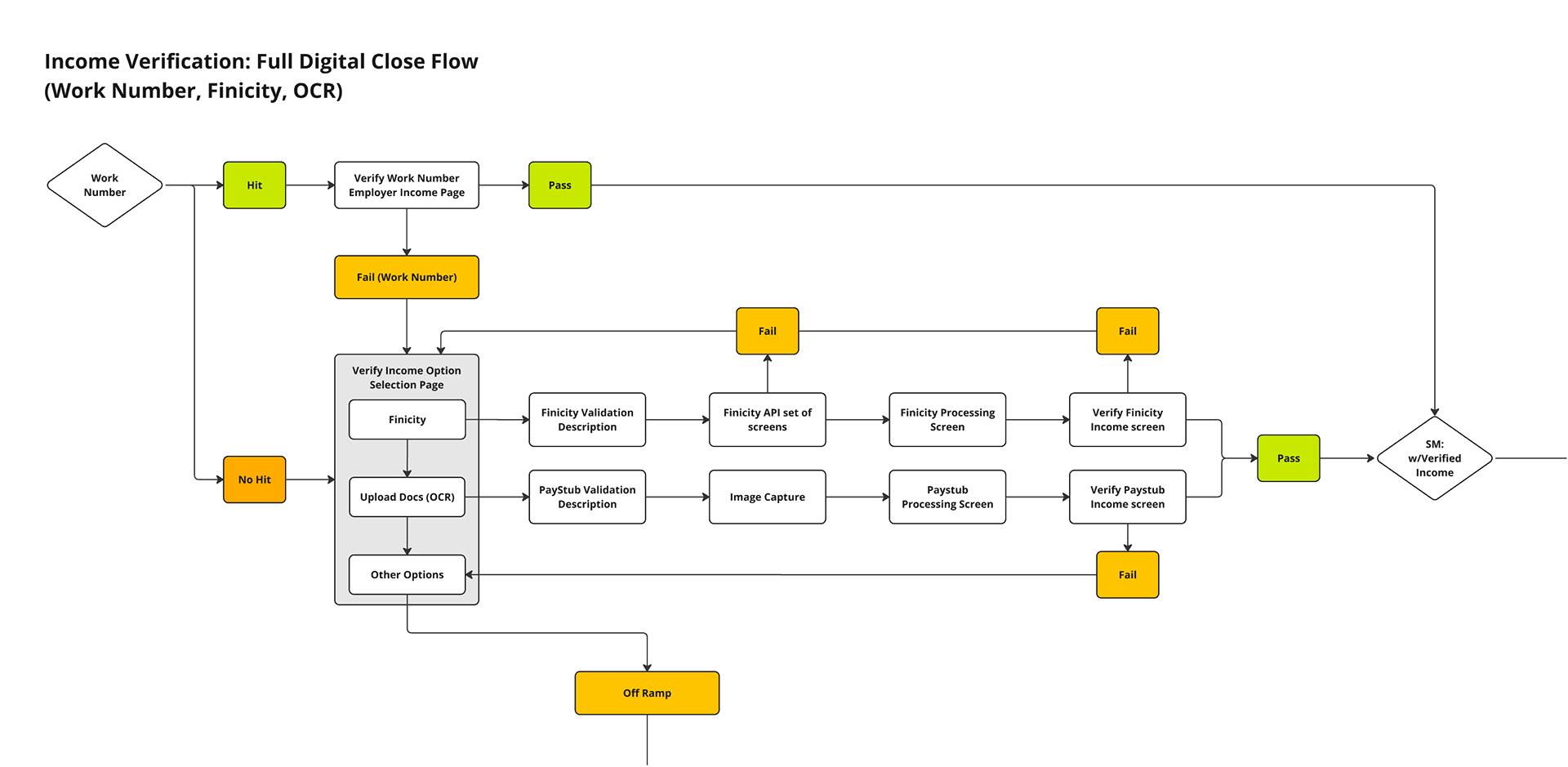

I created several process maps to document 1) How the back-end income verification process works. And 2) Pinpoint where users were dropping off along the sales funnel. Having a holistic view of verification and the sales funnel allowed our team to uncover and discuss a significant point-of-pains for many borrowers.

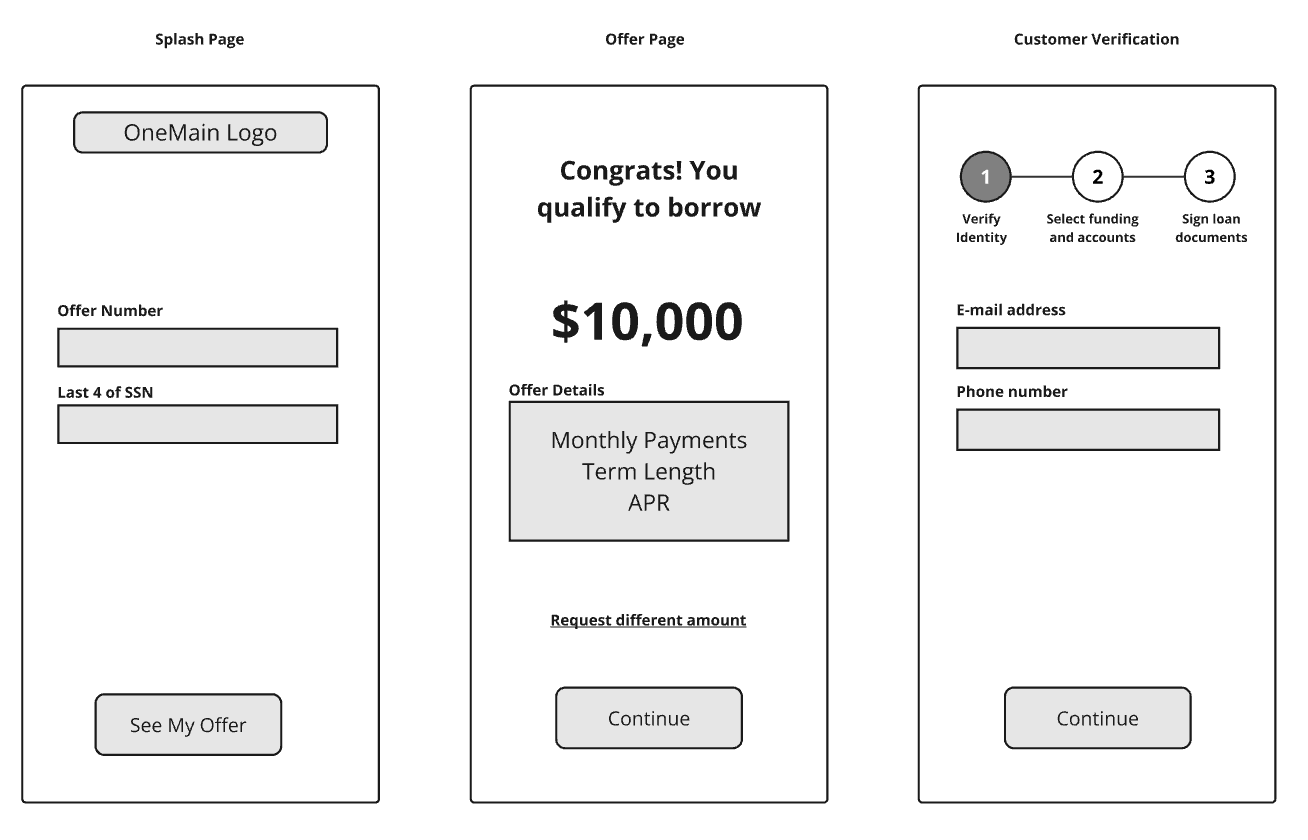

Coupled with additional user research, the team determined that a major deterrent to taking a personal loan is the credit check that can negatively affect a borrower's credit score. In an effort to remove this friction for the user, Our team envisioned a direct mail offer for select good-credit borrowers at a fixed amount with no credit check required.

A FastCash app was then pitched to senior leadership as a way to improve the click through rate and streamline the lending process for these select borrowers. As I began to content mapping and wire framing the mobile UI, these process maps informed the requirements and features crucial to our MVP product launch.

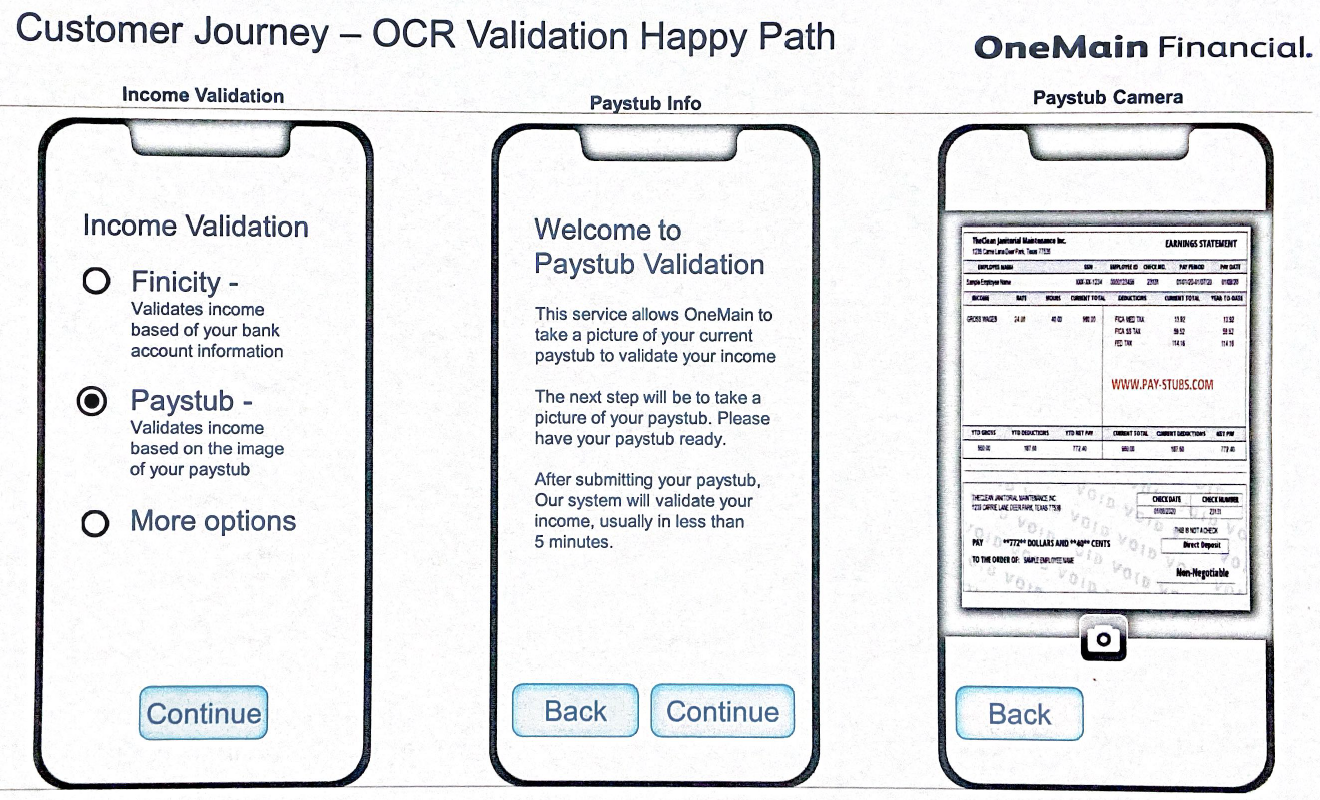

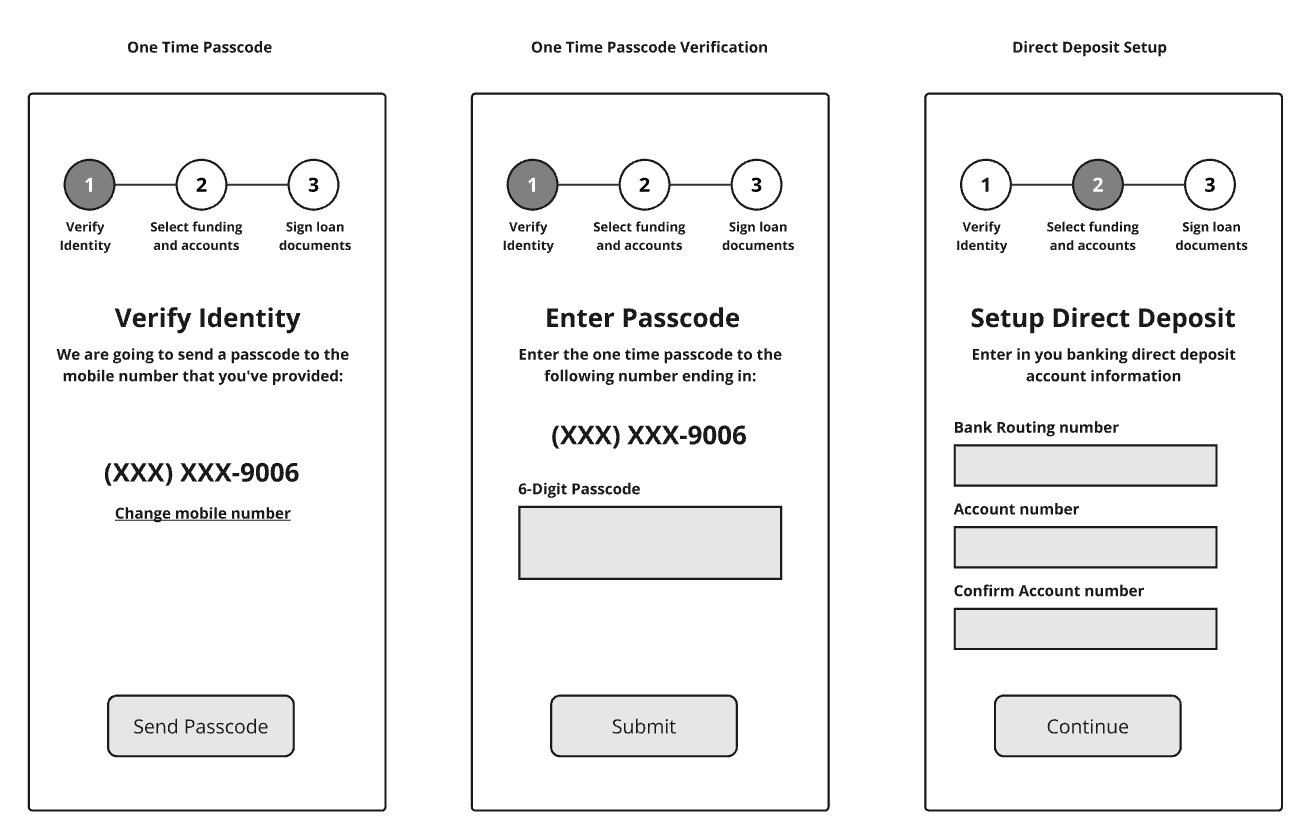

Wire Framing

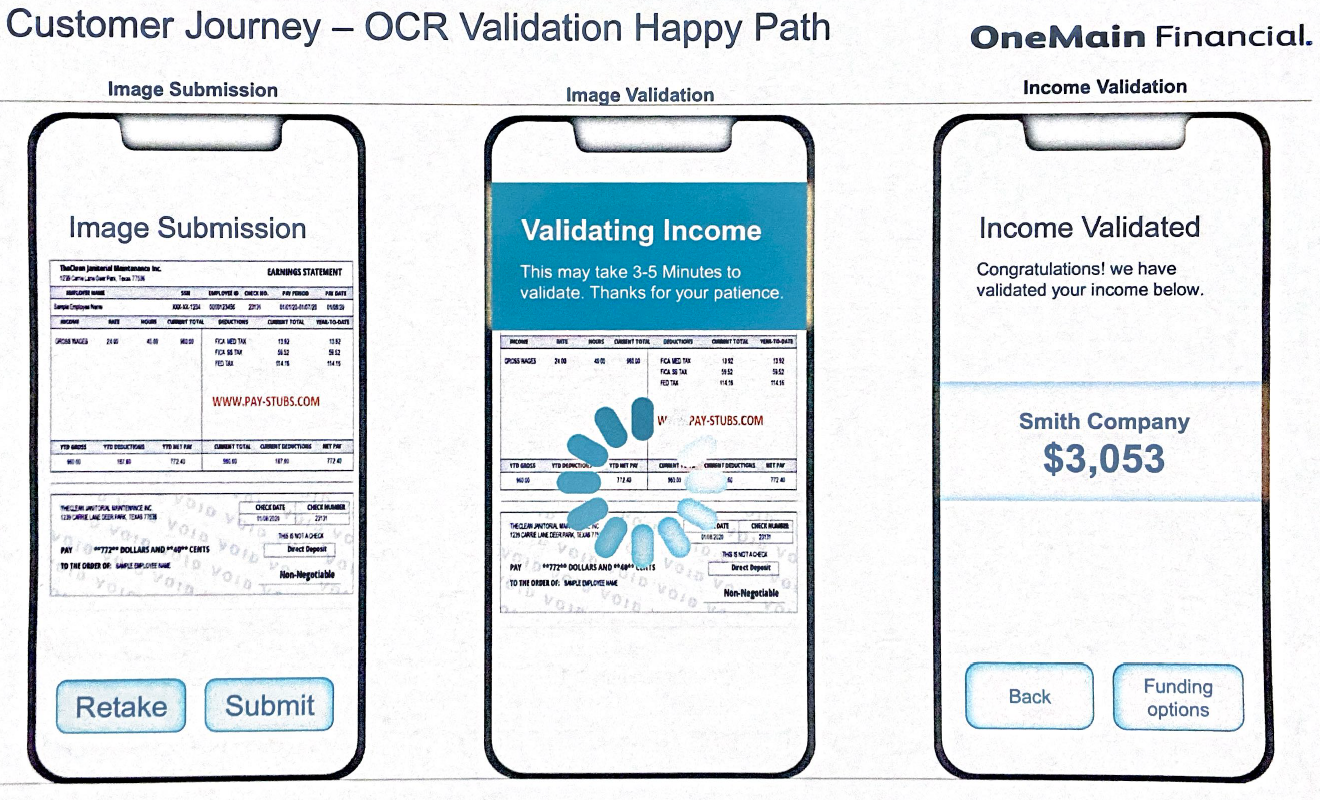

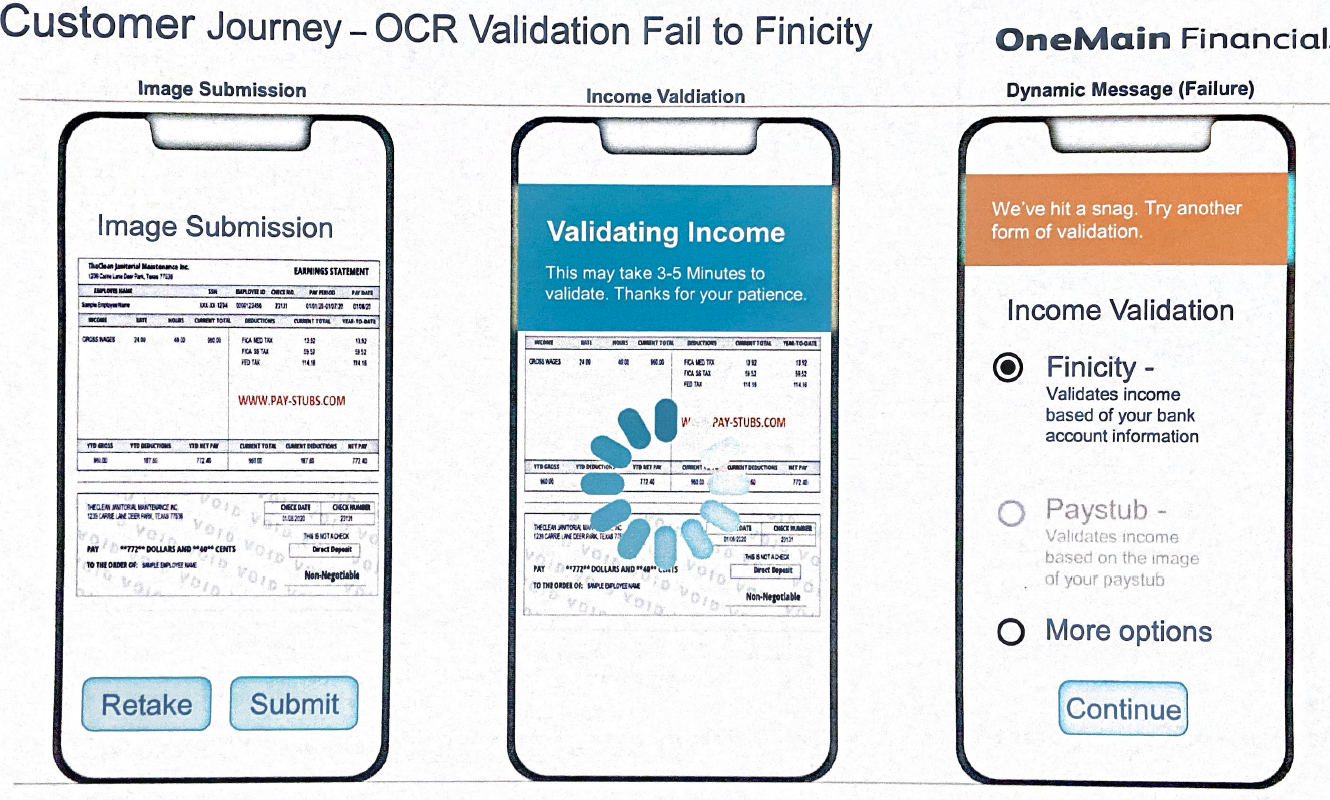

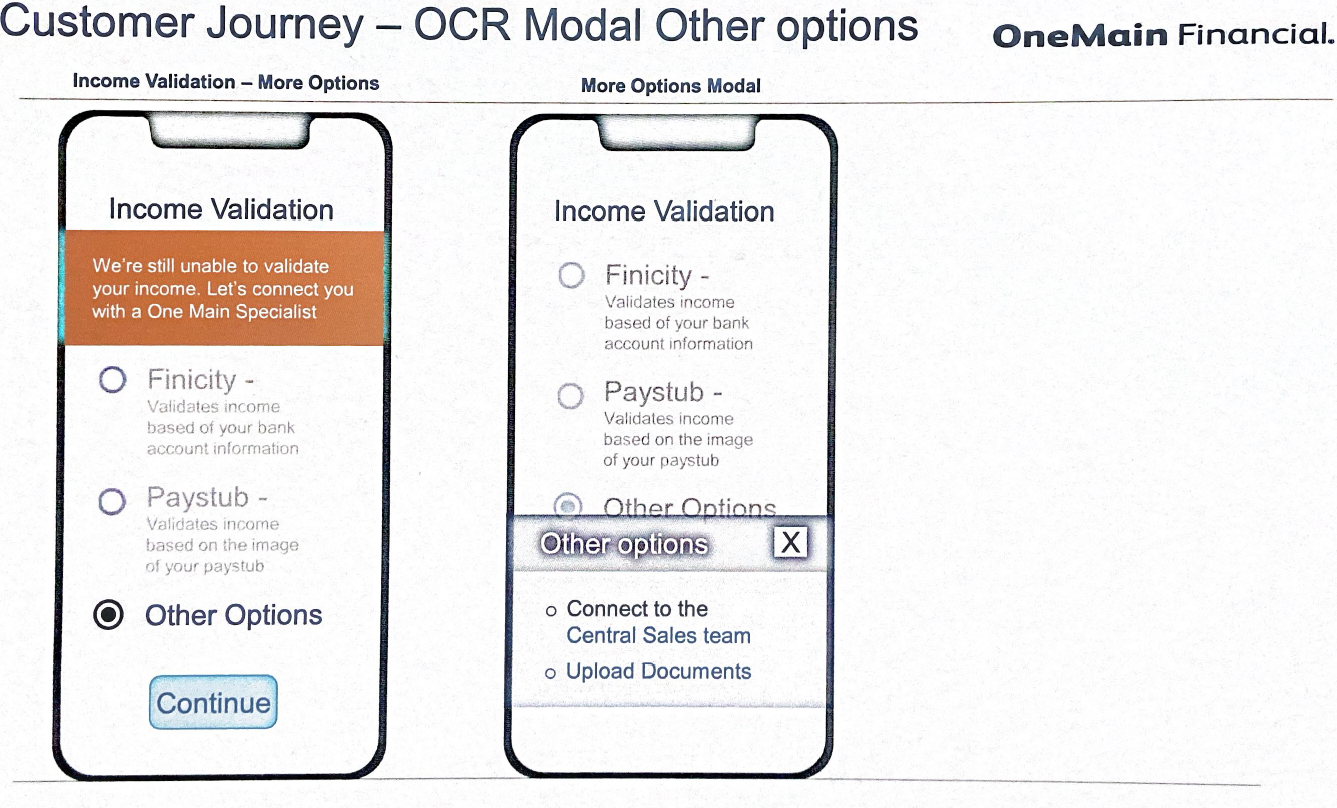

The initial draft enabled an in-depth conversation on implementing optical character recognition (OCR) to help verify income. After constructing a process map, I created more wireframes for what income validation might look like.

High Fidelity Mockups

In order to create a functioning rapid prototype for senior leaders, I quickly skinned and refined the wireframes to align with the enterprise design system branding. Click here for the Figma Prototype

Business Impact

The launch of this product directly improved FDC funnel attrition by addressing key points of pain for borrowers including soft and hard credit check pulls. An improved UI funnel process further reduced drop-off by simplifying the user experience and limiting the number of steps that customers needed to complete their loan. User testing and heuristics supported these findings than the responsive version of the web experience. But more than that, senior leadership saw the benefits of having a designer on the OmniChannel product management team.